Are you considering purchasing a new home using an FHA loan? Understanding FHA mortgage limits is crucial to navigating the borrowing process successfully. Let’s delve into what FHA mortgage limits are and how they impact your buying power.

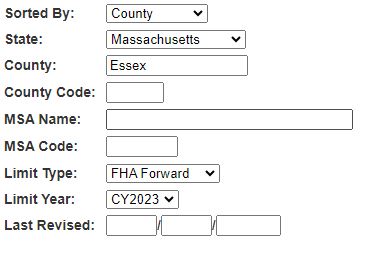

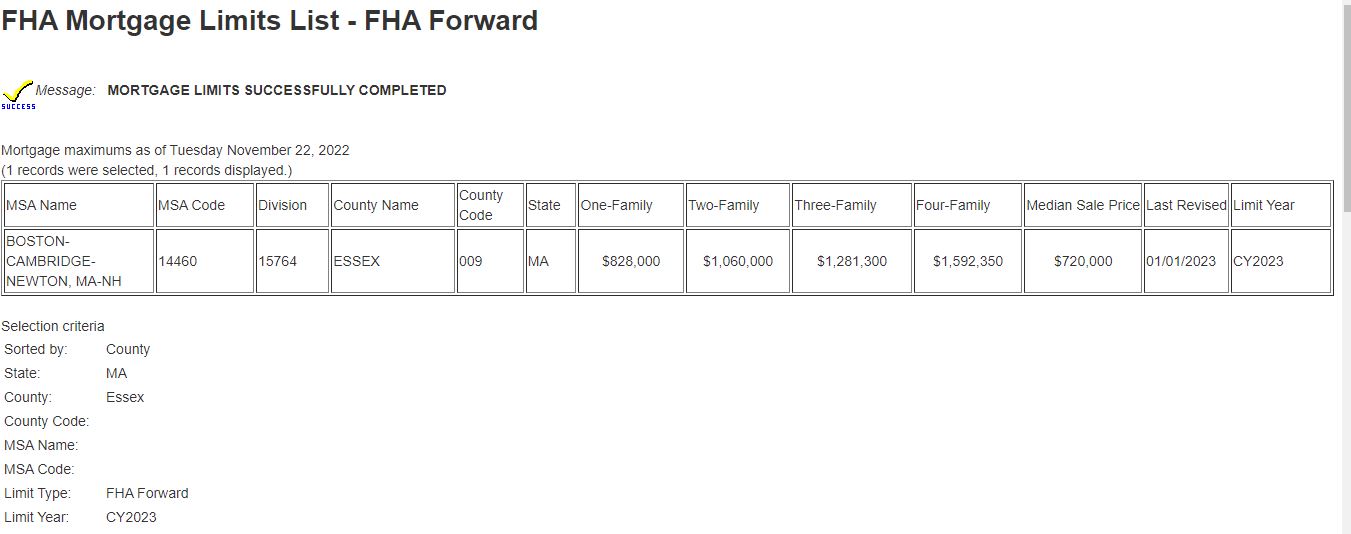

What are FHA Mortgage Limits? FHA mortgage limits, also known as FHA loan limits, are the maximum loan amounts that the Federal Housing Administration (FHA) allows for homebuyers in specific areas. These limits vary based on the county and are recalculated annually to align with changes in housing market conditions. You can check yours from the link https://entp.hud.gov/idapp/html/hicostlook.cfm Example Essex County, MA

The Importance of Knowing FHA Mortgage Limits Knowing FHA mortgage limits is essential for prospective homebuyers as it directly influences the size of the loan they can obtain. Exceeding the FHA loan limits may require borrowers to explore alternative loan options or provide a larger down payment, potentially impacting their homebuying plans.

Benefits of FHA Loans FHA loans have long been favored by first-time homebuyers due to their low down payment requirements and more lenient credit qualifications. Understanding the loan limits empowers buyers to make informed decisions and take full advantage of the benefits offered by FHA financing.

Factors Affecting FHA Mortgage Limits Several factors influence FHA mortgage limits, such as property location, property type (single-family, multi-family, etc.), and the number of units in the property. Being aware of these factors helps buyers gauge their eligibility for FHA loans and strategize their home search accordingly.

Navigating FHA Mortgage Limits: Tips for Homebuyers

- Research Local Limits: Stay updated with the FHA loan limits specific to your area. The Department of Housing and Urban Development (HUD) provides an easy-to-use tool to check the current limits.

- Work with an FHA-Approved Lender: Partnering with an FHA-approved lender ensures you receive accurate information and personalized guidance tailored to your financial situation.

- Consult a Real Estate Agent: A knowledgeable real estate agent can help you explore properties within FHA loan limits and negotiate the best terms for your purchase. Contact me.

- Pre-Approval Process: Get pre-approved for an FHA loan to determine your borrowing power and streamline the buying process.

In Conclusion Understanding FHA mortgage limits is key to making informed decisions when pursuing an FHA loan. By staying informed and partnering with experienced professionals, you can unlock the full potential of FHA financing and turn your homeownership dreams into reality. Remember, knowledge is your most powerful tool in the world of real estate. Happy house hunting! 🏠🔑🌟

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link